Do you remember any Super Bowl advertisements? Maybe the Coinbase ad that had the whole family singing “Everybody” by the Backstreet Boys, or maybe the unsettling moment Claude warned us that ads were coming to […]

Do you remember any Super Bowl advertisements? Maybe the Coinbase ad that had the whole family singing “Everybody” by the Backstreet Boys, or maybe the unsettling moment Claude warned us that ads were coming to […]

Entertainment as a Global Marketing Strategy Modern marketing management focuses on value creation through integrated systems instead of isolated transactions. A strong example of global marketing is the recent Stray Kids world tour, DominATE, and […]

Armonia, or Harmony, is the official theme for the 2026 Milano-Cortina Winter Olympic Games, one that represents this particular Games’ broader vision for the world beyond sports [7]. Unlike traditional Olympic ceremonies held in a […]

Marketing campaigns often tap into human emotions to influence decision-making. Two of the most powerful emotions marketers leverage are fear and hope. Fear-based marketing warns consumers about risks and negative consequences, while hope-based marketing inspires them with possibilities and positive outcomes. Both strategies can be effective, but the key is knowing when, where, and how to use them [1].

International trade policy issues, tariffs, and changes in consumer behavior have presented challenges to trade for U.S. businesses in the last few years. Many firms are analyzing supply chain alternatives and attempting to bring production closer to home in order to mitigate tariff obstacles, promote brand loyalty, and consider the increasing desire for American goods. However, branding “Made in America” has its pros and cons and requires effective strategy and communication. [1].

In the ever-evolving world of marketing, understanding the intricacies of consumer psychology is akin to finding a hidden treasure map. Brands that tap into the psychological triggers of their audience can create not only one-time buyers but lifelong brand advocates. Let’s explore how some leading companies masterfully leverage consumer psychology to build unshakeable brand loyalty [1].

n the ever-evolving world of streaming, competition among platforms like Disney+, Netflix, Amazon Prime, and HBO Max is fierce. With subscription fatigue setting in, fluctuating content libraries, and price increases becoming a norm, streaming giants are grappling with the same challenge that many businesses face: retaining their existing customers while continuing to grow. The strategies they employ offer valuable lessons for marketers across industries. Here are key takeaways from the streaming wars and how they can be applied to your marketing strategy [1].

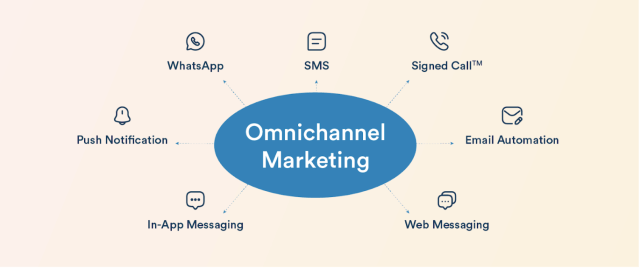

In today’s fast-paced, digital-first world, consumers are no longer tied to a single shopping channel. They might browse on their smartphone, research on their laptop, and make a final purchase in a physical store — or vice versa. This fluid journey between online and offline touchpoints creates both opportunities and challenges for brands.

The solution? Omnichannel marketing

In an increasingly globalized world, branding strategies must adapt to regional tastes, cultural nuances, and consumer behavior. For businesses expanding across continents, understanding the differences in branding approaches between the United States and Europe—particularly Western and Central Europe—is key to establishing a strong and resonant presence [1]. In this post, we’ll explore some of the critical distinctions in branding strategies and consumer expectations across these regions[2].

In an age inundated with information and constant noise, the ability to cut through the clutter is more essential than ever for brands. One of the most powerful tools at a marketer’s disposal is storytelling. Effective storytelling not only captures attention but also forges deep emotional connections between brands and consumers. As competition increases and consumer preferences shift, understanding how to leverage storytelling effectively can significantly enhance a brand’s marketing strategy [1].